The Ultimate Guide to NFTs: Use Cases, Platforms, Where to Buy and Sell

What are NFTs? This detailed guide defines NFTs, reviews the main use cases for nonfungible tokens, platforms, the most influential projects and people.

NFT or nonfungible tokens are crypto assets that are not interchangeable. If Bitcoin or ETH could be compared to dollar bills (each one is valued at exactly $1 and you don’t care which one you hold), then NFTs are like paintings, rare postmarks, and gems. Each NFT is unique and its value is determined by the market. In this post, we’ll deep dive into nonfungible tokens and their role in the digital economy.

What are NFTs?

Fungible tokens are the ones that could be exchanged for one another. Nonfungible tokens are the opposite.

NFTs are:

- Verifiable — can track ownership back to the issuer;

- Indivisible — can only buy the whole NFT;

- Immutable — you really own it and nobody can cancel the sale, destroy the token or control its movement.

Each nonfungible token typically has rich attributes that are defined in its smart contract:

- Owner — a crypto address that holds the token;

- Metadata (could include things like color, traits, etc);

- Links to media such as images, video, or music.

NFT use cases

Nonfungible tokens could be used to create verifiable digital scarcity, which is important for:

- Art — each NFT could act as a unique art piece;

- Gaming — tokens could be used as game assets;

- Collectables — tokens become something that’s collected, exchanged, and traded, much like traditional collectables such as stamps, coins, precious gems etc.

Let’s dive into use cases for nonfungible tokens.

Crypto Art NFTs

Just like regular art, cryptoart is not easy to define, it’s often weird and that’s the beauty of it.

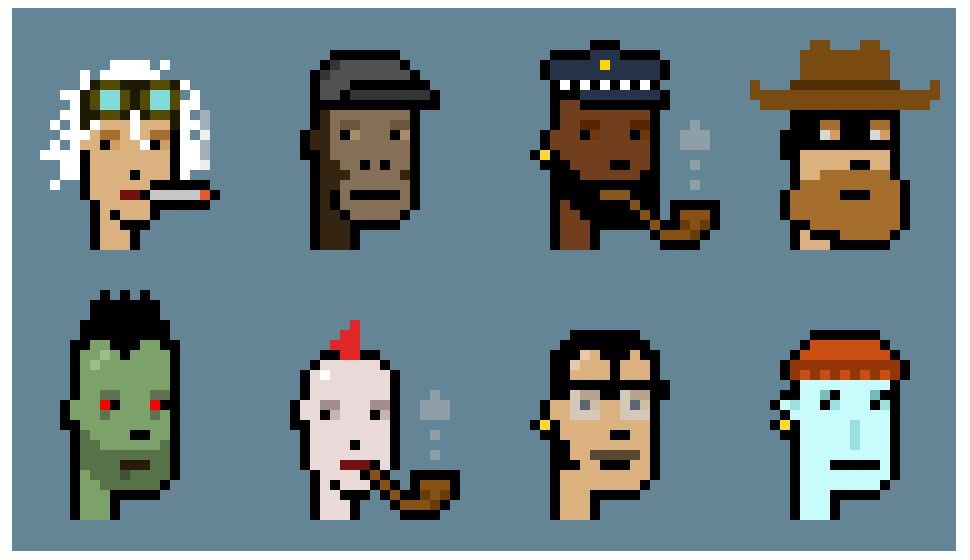

Launched in June 2017, CryptoPunks are considered the first NFT art project. A set of 10,000 small (24x24 pixels each) images that were generated algorithmically, these “punks” were up for grabs by anyone with an Ethereum wallet.

Most of the cryptopunk characters are human (male and female) but there are also 88 Zombies, 24 Apes and 9 Aliens. Each punk also has different attributes such as skin colour, hats, eyewear, facial hair, etc. Rare punks are pricier: the most expensive Alien sold for $600k.

When CryptoPunks were launched, no nonfungible token template existed, so Larva Labs, the creators, built their own smart contract. Later, the whitepaper for the first and still dominant NFT standard, ERC-721, specifically referred to CryptoPunks as the source of inspiration. Token standards are important because they make it easy to interact with ever-increasing universe of different smart contracts and wallets.

While undoubtedly innovative from a tech perspective, CryptoPunks were a fun experiment and only later were recognised as “art”. In 2018, the authors spoke at Christie’s, featured in the mainstream media, and eventually grew to accept themselves as artists. The whole 2017-2018 crypto boom attracted a lot of attention to the whole idea of “crypto art”.

Here are some other notable crypto art projects:

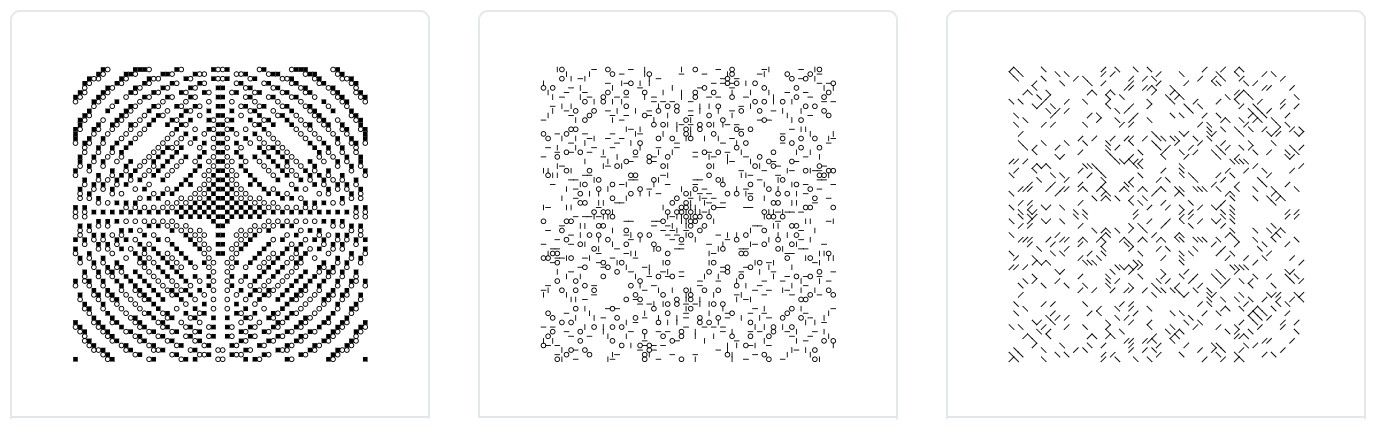

- Autoglyph (2019) — Larva Labs, the authors of CryptoPunks, has created the first “art on the blockchain”: the whole piece is included in the NFT token on the Ethereum blockchain. The smart contract generates a set of symbols that form an elaborate pattern. The code could generate billions of unique images but only 512 were to be ever created. To create each NFT, the original owner called the smart contract to generate each image while simultaneously donating 0.2 ETH to charity.

- Asynch.art (Feb 2020) is a platform that enables artists to create ‘Master’ art pieces that could be later be changed with ‘Layers’. The Master is the original canvas, which could be owned like any other NFT. Each Layer gives the owner a right to change a set of characteristics in the Master: colours, shapes, whatever the artist defined. Importantly, the owner of the Layer changes the Master regardless of who owns the Master. This enables the collectors to co-create with the artist. In October 2020, an Asynch piece by Robert Alice became the first NFT sold on Christie’s, fetching $131,250.

- In December 2020, digital artist Beeple sold his first NFT drop on Nifty Gateway. His next drop of 21 pieces sold for a record $3.5 million. While Beeple has already had 1.7 million followers on Instagram, he has only learned about NFTs just a few months before the sale. The high selling price and the mysterious buyer who snatched 20 pieces brought a lot of attention to the sale.

- Hashmasks (Jan 2021) launched as a digital art project created by a community of 70 artists. Each of 16,384 unique digital portraits was created by a combination of artists include six attributes: a character, a mask, an eye color, a skin tone, and a background. The holders of Hashmasks also accumulate 10 Name Changing Tokens (NCTs) for every day they hold the NFT. With 1,830 NCTs (a half a year’s worth of holding), the holder can burn these tokens and change the name of the Hashmask. This way collectors can co-create with artists.

If you want to track NFT art trends, including current sales, artists, and more, you should bookmark Cryptoart.io.

Benefits of NFTs for artists

- Direct sales. Artists can sell directly to the audience, bypassing galleries and curators.

- Digital-first. Prints can work for some CGI images, but not for pixel art, GIFs, video, VR and new interactive digital formats that are being developed. A token could be seamlessly weaved into a digital experience — or at least less crudely than a traditional print.

- Co-creation. Smart contracts open up new opportunities for artists, the audience, and collectors to interact. Artists could write the rules for how the pieces are created and evolve.

Crypto Gaming NFTs

What’s more fun than art? Games! That’s another big area where NFTs experiments are happening.

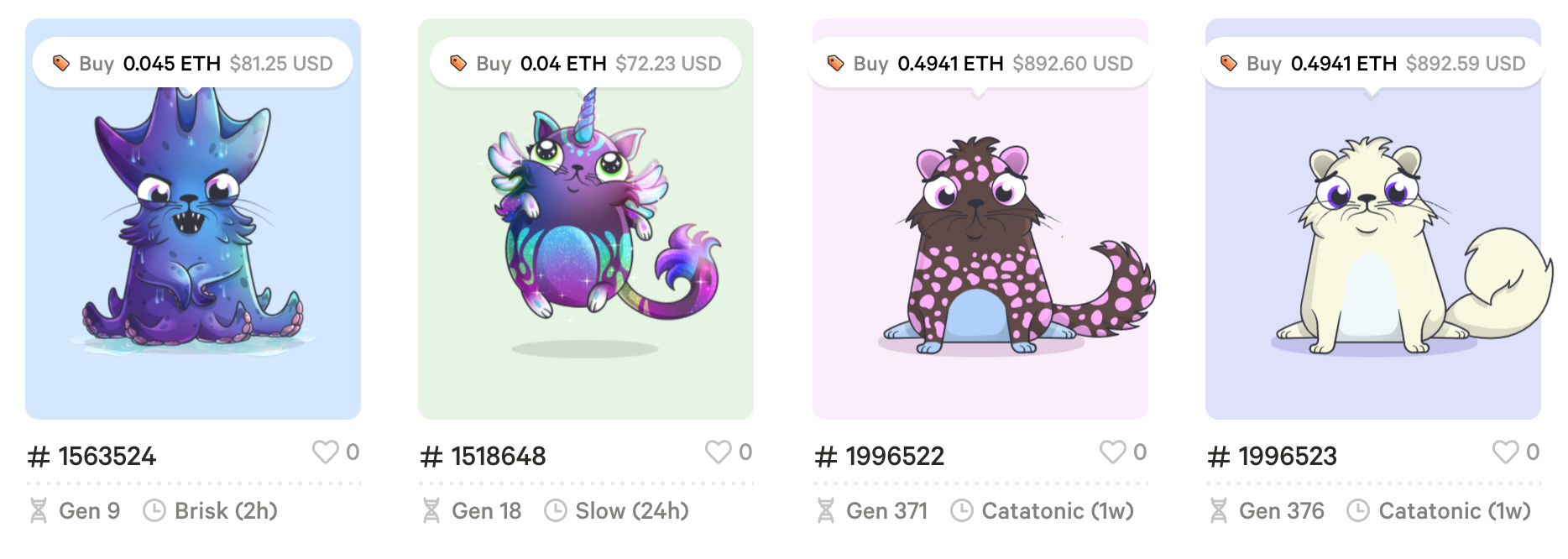

Launched in the middle of the 2017 crypto boom, CryptoKitties by Dapper Labs are probably the best-known NFT game. If you haven’t heard of it, the idea is simple: you can buy some digital cats, each one is an NFT with unique attributes, and then “breed” them to produce new cats with attributes of their “parents”. Some cats are common and some are rare, fetching $100,000s. That’s pretty much all you could do: breed, sell and buy. Still, in November-December 2017, the game was so popular that it clogged up the Ethereum network that was already struggling with transaction throughput.

In 2018, Axies Infinity launched another breedable digital NFT pets that could also battle. Compared to CryptoKitties, the gameplay is a lot more advanced. Each Axie has different stats and abilities akin to Pokemon. The game is actively evolving thanks to supporting from Ubisoft, the gaming giant behind games like Assassin’s Creed and Farcry. Crypto exchange Binance also supports the game and this shows in the growth trajectory: in January the game hit 20k daily active users despite record-high ETH gas fees. The most expensive Axie called Angel sold for $130k.

Decentraland is a VR world (or “metaverse”) on the Ethereum blockchain where people create, hang out, and play. In that world, people use $MANA token (a fungible token, i.e. an in-game currency) to buy items that are represented as NFT tokens. As the name suggests, the game is centred around land: users can buy parcels to build whatever they want. In 2017, Decentraland raised $26 million, selling $MANA token.

The Sandbox is a sandbox game (think Minecraft) that was first launched in 2012 and by 2019 has reached 40 million downloads and 1 million active users. In 2018, the game was acquired by Animoca Brands to relaunch it as a blockchain world-building game in which gamers could “play-to-earn” and monetize their creations. The Sandbox uses NFTs to represent all kinds of in-game assets, from skins and items to land plots and mini-games. In December 2019, the company sold $3 million worth of $LAND (the NFT tokens representing land in the game) on Binance.

Aevegotchi, launched on 2 March 2021, is a new take on breedable digital NFT pets, now with DeFi and fully on-chain (what a mouthful!). To translate this to normal English: unlike CryptoKitties, which stored images and most data on conventional servers, Aevegotchis exist fully on the blockchain. Like with CryptoKitties, the gameplay is all about creating and trading the rarest pets. In Aevegotchi, however, the rarity scores are explicit and the holders of rarest pets get $GHST, a currency that’s used to create new pets (nonfungible tokens).

It’s not just weird crypto geekery, big brands are joining too. Microsoft-owned Minecraft launched a browser game that rewards players with NFTs that could be used in the game.

Benefits of NFTs in games:

- Scarcity — NFT items are registered on the blockchain with known quantities that are defined by the smart contract;

- True ownership — gamers control the items, can trade and exchange them;

- Cross-platform gameplays — NFT items could be moved across different platforms, games, and external smart contracts.

NFTs as crypto collectibles

In addition to edgy digital art and geeky games, NFTs could also represent collectables that are just collected for the sake of collecting.

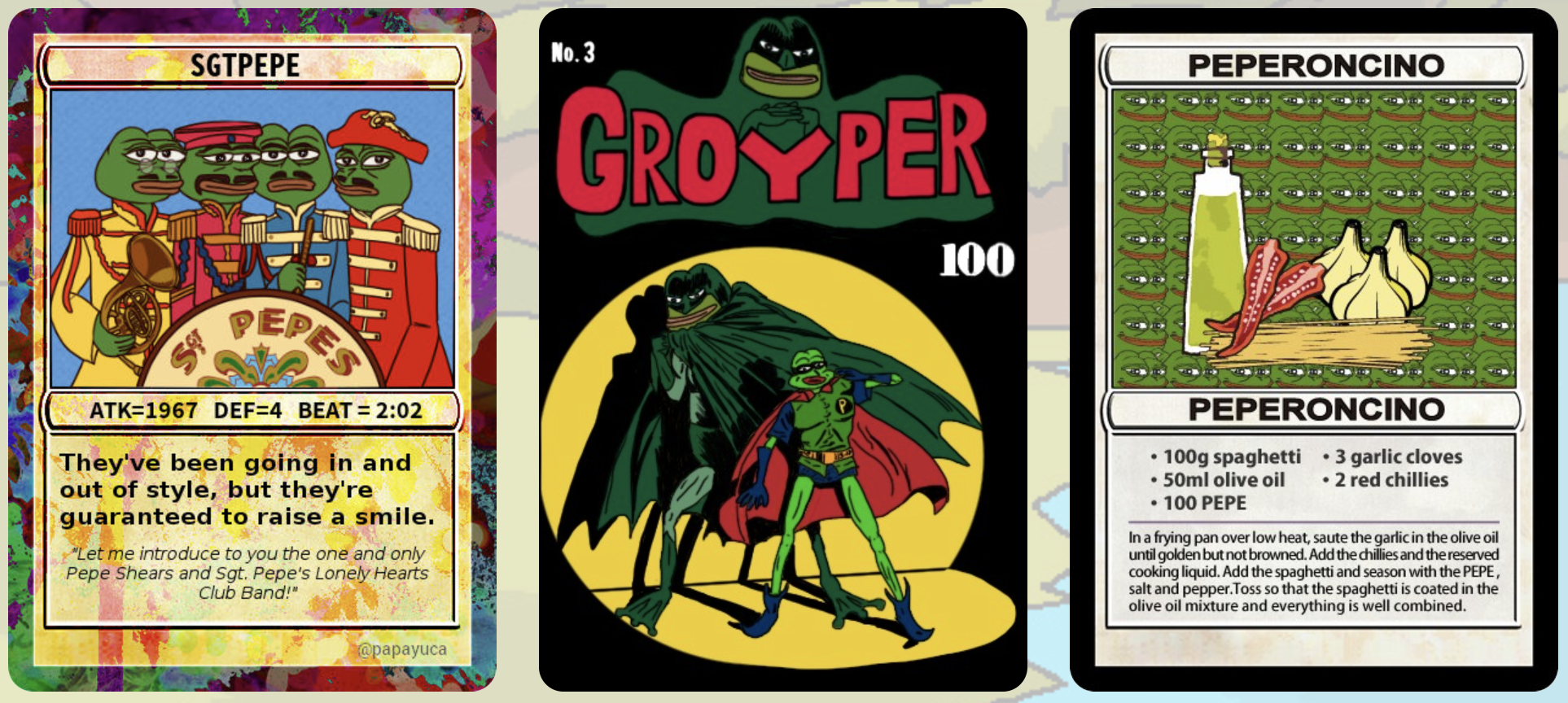

Trading cards like Magic the Gathering are a great use case for NFTs. In fact, one of the first non-fungibles is ‘Rare Pepe’ cards that have a familiar trading card layout. Launched in 2016 on Counterparty, the layer on top of the Bitcoin blockchain, the tokens feature variations of Pepe the Frog meme.

Pepes started as an experiment way before the full-blown crypto mania. Anybody could submit their artwork and trade the cards and a new community formed around the project. Now some Pepes command prices in tens of thousands of dollars.

In contrast, most successful NFTs that are launching now are usually linked to existing audiences.

Professional sports and NFT collectibles are a perfect match because millions of fans already collect items that are connected to their favourite teams and players. For them, the brand or personality is primary and physical form (cards, hats, scarves, etc.) are secondary.

NFTs shift the audience’s emotional connections from physical to online dimensions. There are already several examples of this.

NBA TopShots, launched by the creators of CryptoKitties, are an official collab with the National Basketball Association. Users can collect ‘Moments’, a combination of photo and video of a game moment from a specific match as well as statistics for that period and the player. Each Moment is an NFT, which comes as common (>1000 copies or mints of each Moment), rare (150 - 999 mints), legendary (25-99), and ultimate (1-3). The first three tiers are sold in ‘packs’ like traditional card or sticker. ‘Ultimate’ tiers will be sold through auction only. Since launching in October, sales exceeded $230 million.

Football NFTs are less prominent now but are rapidly developing. Sorare, a global blockchain fantasy football game, already signed licensing agreements with 120+ football (aka soccer) clubs, including Liverpool, Real Madrid, Juventus, and more. Users can buy player cards as NFTs, which could be traded, used in Sorare fantasy football, and eventually even in third-party games, at least that’s the company’s aspirations.

Adding elements of gaming to the collector experience should probably increase engagement.

F1 Delta Time by Animoca Brands (the owner of The Sandbox game) is an officially-licensed Formula 1 game in which both cars and racing tracks are NFTs. Tracks also earn rewards in the form of REVV (Animoca’s fungible ERC-20 tokens): depending on rarity, tracks bring 5% to 25% of gameplay fees and 3% to 21% of staking yields. In December 2020, an NFT representing 5% ownership in the virtual Monaco Grand Prix track was sold for $223,000.

NFT collectibles for fan audiences obviously work beyond sports: brands, celebrities, and influencers can monetise their audiences with tokens in similar ways to selling any other licensed products.

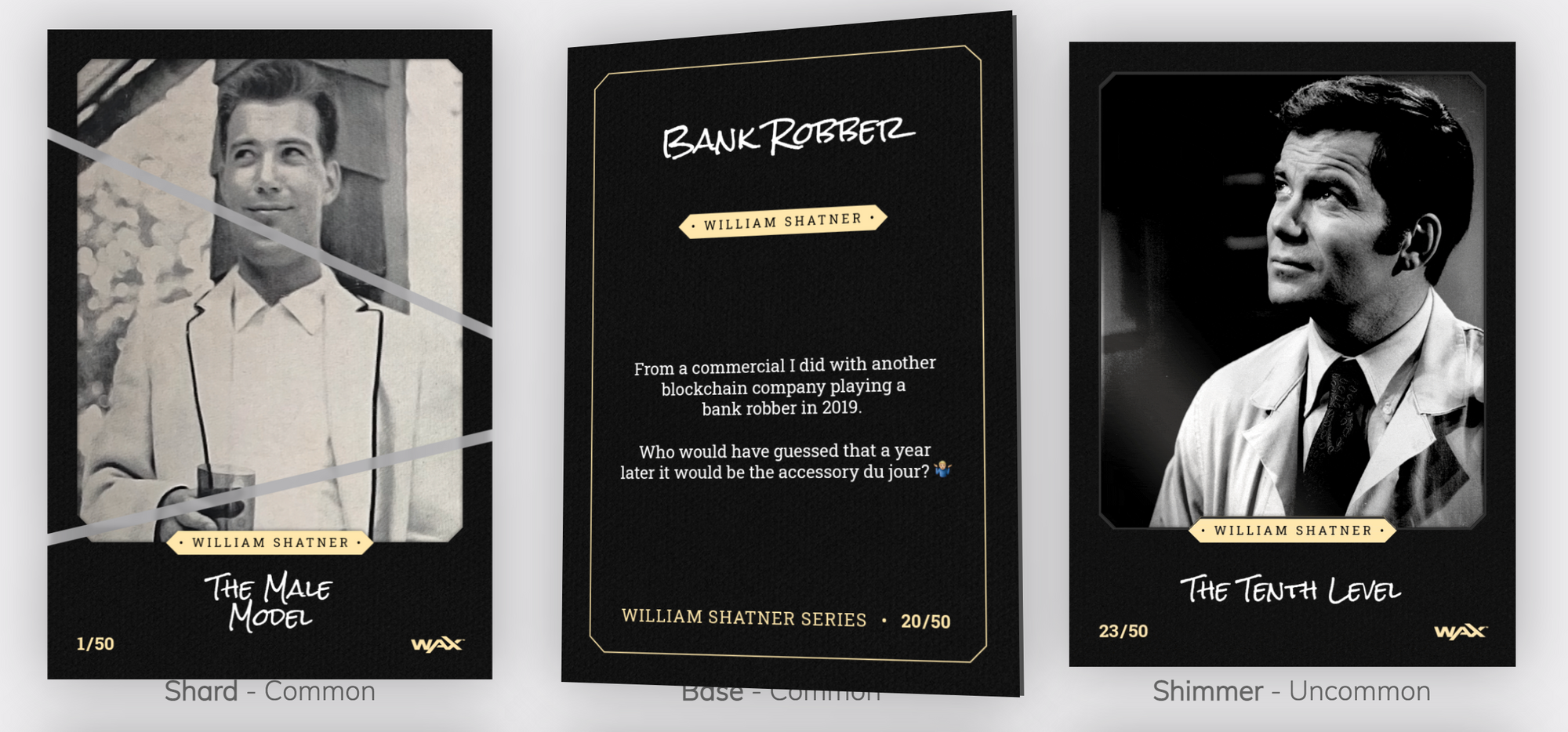

William Shatner, best known as Captain Kirk from Star Trek, minted his NFT cards with photos, selling 10,000 packs in 9 minutes. The family of late Leonard Nimoy, another Star Trek legend, are following suit.

Popular TV series are also joining. American Gods have dropped officially licensed characters NFTs.

NFTs collectibles could also have unique digital capabilities such as accessing exclusive content.

For example, DJ 3LAU sold $11 millions worth of NFTs, which include access to unreleased music with a custom player on the DJ’s webisite. His top-ranked NFT was reserved for the top bidder and gives the right to offer creative direction to a custom song, i.e. a co-creation opportunity.

Kings of Leon just launched their new album as an NFT, racking in $2 million in the first five days. The NFT includes a digital album download and a digital album artwork. Unlike 3LAU’s more advanced audience, many of Kinds of Leons fans were first-time crypto users so the sale is extended.

Physical objects could also be connected to NFTs.

In 2019, Nike filed a patent for “CryptoKicks”, a “system and method of cryptographically secured digital assets” for physical items like sneakers. Buying a pair of CryptoKicks shoes will also give digital assets that uniquely identifies the shoes on the Ethereum blockchain.

Around the same time, LVMH, the owner of Louis Vuitton and other luxury brands, announced AURA, a blockchain consortium for the luxury industry. While AURA is a permissioned (i.e. controlled and not decentralised) enterprise version of the Ethereum blockchain, the initiative highlighted the importance of traceability for luxury goods and the role blockchain could play. NFT might be a better format, especially given a growing excitement and eyewatering prices.

Crypto assets

While art, games, and collectables are now in the spotlight, the truly disruptive potential of NFTs lies in the uncharted area of pure crypto assets. Anything that is now represented with a physical object or a legal document could theoretically be turned into an NFT.

- Property titles. Tokens could represent any assets but digital ones are the best fit. For example, domain names on the Ethereum Name Service (like vitalik.eth) could be turned into NFTs. At present this isn’t a default, but smart contracts for the ENS domains are already compliant with ERC-721, meaning that all .eth registrations could be transferred like any other token.

- Credentials. Transferable licenses or certificates could also be represented by NFTs. For example, holding an NFT could authorise its holder to access or use some asset, receive cashflows, or give some other rights.

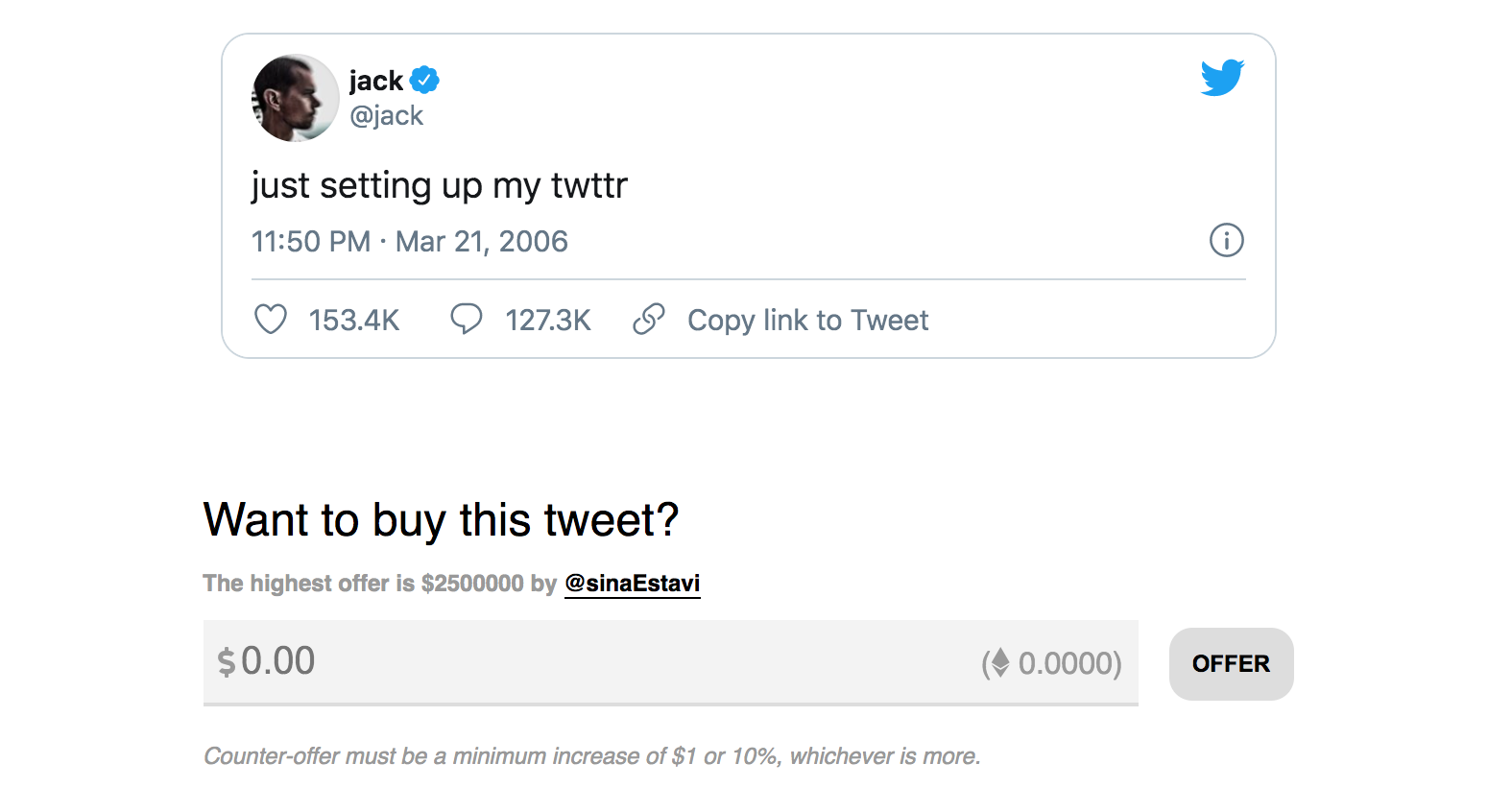

- Copyrights. Signatures were the original copyrights and that could easily be represented by NFT. A creator could issue an NFT for each piece, certifying its authenticity and keeping or transfering the copyright. Cent does this by signing tweets as NFTs. Twitter founder Jack Dorsey's first-ever tweet is being auctioned, going now for a mere $2.5 million (he'll donate to charity).

- Insurance. Decentralized pooled “insurance” (more precisely mutuals where members can buy cover to protect against risks) yInsure provides smart contract cover as NFT. Each token is a cover for a certain amount of crypto that would be paid out in case of failures of a specified smart contract by some date. Each NFT is tradable, which could help with price discovery and quantifying risks.

- Badges. Unicef mentioned using NFT digital badges as a way of recognising participation or effort. And “virtual popstar” @lilmiquela already did this, selling an NFT to raise $82,361 for BlackGirlsCode.

Where to buy NFT

More and more platforms issue NFTs and many also offer secondary markets for buying and selling NFTs from current holders.

NFT platforms

- OpenSea is the first and largest marketplace for NFTs of all kind, including art, sports, gaming, etc. The current and previous listings include Axies, ENS domains, CryptoKitties, and 700 other projects. Users can create collections to browse NFTs in their wallets. While its primarily a secondary market, users can also create new NFTs without paying any gas fees (the token simply isn’t transferred on-chain until the first sale). Another cool feature is ranking, which shows various statistics for sales of NFT categories and projects linked to the platform.

- Founded in 2018, Nifty Gateway is a marketplace for buying and selling NFT art. New pieces are delivered as ‘drops’ (also referred to as exhibitions in a nod to the traditional art market), events when artists sell their new NFTs. The Nifty team selects the artists, either inviting them directly or reviewing the open application. Collectors can withdraw NFTs from Nifty Gateway, but only pieces issued on the platform could be deposited and sold. Nifty Gateway sold Beeple’s first NFTs in December 2020 and later his artwork for $6.6 million.

- Rarible allows anyone to create and sell NFTs. Artists can mint NFTs in just a few clicks using Fortmatic crypto wallet. Creators can add “unlockable content” which could include links to images, videos, etc. Some creators are “verified” badges that are added based on creators’ social media accounts to prove the authenticity of their works. Finally, artists can also enable royalties for their NFTs: they would get a % of all sales of the same token but currently only on Rarible.

- SuperRare positions itself “like Instagram meets Christie’s” only onboards a small number of selected artists. They plan to scale and has an open application for artists (digital art should be sold exclusively on their platform). The secondary market has commissions of 10% from each sale and it all goes to the artist.

- Oncurio is a marketplace for digital collectibles, catering mainly to fans of shows, graphic novels, movies, etc. NFTs are available during drops or via auctions and buyers can pay by crypto or debit/credit card. Oncurio NFTs are ERC-721 that collectors could also resell on OpenSea, Rarible, and other marketplaces. However, the NFT’s rich media is now only viewable on the platform’s “flexing” tools as they put it.

- KnownOrigin is an “artists-driven” platform for minting and selling NFTs. Artists are selected by application. First launched in 2018 as a proof-of-concept, it went through a major update to give more emphasis to art itself.

- MakersPlace is a platform that enables artists to launch and sell authentic artworks in form of NFTs. Buyers can by crypto or card. They most recently have partnered with Christie’s to sell Beeple’s The First 5000 Days.

- Foundation is one of the newest platforms, having launched in February 2021. In their first month they’ve sold nealy $2 million worth of artworks, including the Nyan Cat meme signed by its creator. They’re already supported over 200+ artists.

Most of the platforms listed above focus on digital art. Sports, fan, and gaming NFTs are usually issued by the brand owners in partnerships with blockchain tech companies.

Importantly, anyone can issue NFTs without using any third-party platform. After all, crypto is decentralized and a nonfungible token is just a smart contract.

NFT creators, artists, and investors to follow

The niche world of nonfungible tokens already has its own group of trendsetters.

Here is an utterly incomplete list of must-follow people on Twitter who will open up your eyes to the sheer craziness of all that’s happening now:

- Beeble is Mike Winkelmann, a digital artist whose NFTs are sold by Christies. He has been making art every day for the past 13 years, now mostly CGI video, and shares his creations with his 1.7 million Instagram followers. He has previously created graphic design and animations for Justin Bieber and Nicki Minaj as well as for brands like Apple and SpaceX.

- John Watkinson and Matt Hall, co-founders of Larva Labs and creators of CryptoPunks. They don’t tweet a lot but following them is a sure way to catch some of their panel discussions and spot things they think are cool.

- FEWOCiOUS is an 18-year old digital artist. Prior to becoming a big name digital artist, he was drawing avatars for cash and has discovered NFTs nearly by accident when one of his clients wanted to pay in crypto. Now he’s sold $3 million worth of virtual sneakers (don’t ask) with his designs.

- MetaKoven is a crypto veteran and the largest NFT collector in the world who has spent $2.2 million on Beeple art.

- TokenAngels, is a group of investors who own Volatility Art by Matt Kane (sold for $100k on Async Art), a unique HomerPepe (bought for $320,000) and other rare NFTs.

- WhaleShark.Pro is a “collector of all things Bleeding Edge and Scarce” who has built a >$70 million portfolio of NFTs.

- Gary Vaynerchuk, entrepreneur, investor, speaker, and best-selling author, is now tweeting a lot about NFTs, comparing the current projects to the Internet in 1999.

Who should be added? Please tweet @ us here.

Keep up with NFT

The NFT world moves at a warp speed of crypto multiplied by art and squared by gaming.

To keep up with it, sign up for our NFT newsletter and get a detailed overview of the current technology, platforms, critical risks and hot opportunities.